Steel Detailing by the Numbers: Key Industry Statistics and Trends

Imagine towering skyscrapers, maze-like stadiums, and massive bridges taking shape from mere sketches to giant intricate structures made of steel. Behind these marvels of modern engineering lies an underappreciated profession—steel detailing. This is a world filled with decimal points, technical diagrams, and very unglamorous drawings. But without steel detailers, even the most dazzling architectural visions would remain impossible dreams.

Let’s delve into some key statistics and trends shaping the global multi-billion dollar steel detailing industry powering construction’s backbone…

Market Size Analysis

The current market size of the global steel industry is estimated to be 105.57 billion in 2022 according to leading research firm Grand View Research. Despite disruptions from the pandemic, steel detailing has witnessed continuous growth over the past decade in line with the expansion of the broader construction sector. The market size has grown steadily from $2.98 billion in 2015 at an average annual rate of 7.2% during this period. Driven by rapid urbanization and big infrastructure projects, the industry is projected to further grow at a CAGR of 6.4% between 2022 and 2025.

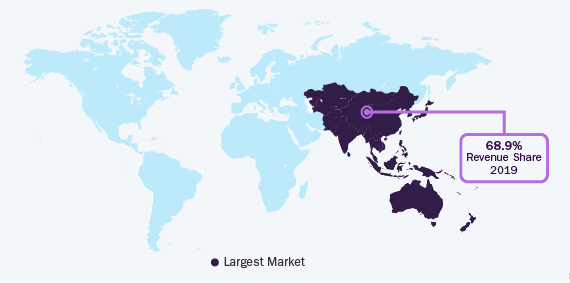

Regional Variations

Asia Pacific is currently the dominant market, accounting for 43% share of the global steel detailing industry as per Steel Detailer Magazine’s 2022 Regional Analysis. This is attributed to major construction activity in countries like China, Japan, South Korea, and Southeast Asia. North America stands second with a 35% industry share, led by steady construction in the United States and Canada. Europe constitutes the remaining 22% share as per the analysis. In terms of growth, the APAC region is also expected to expand at the fastest CAGR of 8.2% through 2025 according to projections by research firm Procurement International. Developed regions like North America and Europe are likely to exhibit lower growth at 3-5% CAGR owing to market maturity.

Technology Trends

The steel detailing industry is witnessing significant technology disruptions and shifts:

- Transition from 2D CAD to 3D BIM– The industry has gradually moved from manual 2D CAD drafting to 3D modeling with BIM. This allows greater coordination and clash detection.

- Automation Using AI/ML – Emerging technologies like artificial intelligence and machine learning are enabling increased automation of repetitive detailing tasks. This improves productivity and efficiency.

- Cloud-based Collaboration – Steel detailing firms are adopting cloud-based tools for real-time collaboration across global teams and other stakeholders. Enables better coordination.

- Adoption of Mobility Solutions – Detailers are leveraging mobility solutions ranging from tablets to augmented reality to enable on-site collaboration, remote working, and portability.

Overall, technology is playing a transformative role in enabling firms to handle more complexity, improve productivity, and deliver greater value.

Cost Analysis

Steel detailing costs are dependent on various project parameters:

- Project Size – There are clear economies of scale, with cost per square foot reducing for larger project sizes. Larger firms negotiate lower costs by leveraging high volumes.

- Building Usage – Commercial, industrial, institutional, and high-rise projects have higher detailing costs per sq. ft. compared to simpler warehouse or residential buildings. More complex requirements drive up costs.

- Location –Developed countries often outsource projects to emerging markets with lower labor costs, enabling 20-30% cost reductions. But offshoring has time zone challenges.

- Lead Times – Aggressive lead times and frequent design changes can increase costs. Stable requirements and reasonable timelines allow optimization.

Overall, average steel detailing costs range from $0.8 to $1.2 per sq. ft. for simple warehouses going up to $3 to $4 per sq. ft. for complex high-rise buildings as highlighted in Steel Detailer Magazine’s annual cost survey.

Future Outlook

The steel detailing market is projected to grow at a CAGR of 6.4% from 2022 to reach $5.89 billion by 2025 according to Grand View Research. This steady growth will be fueled by increased construction activity globally. Developing regions are likely to drive faster growth while mature markets grow slower. Firms need to enhance productivity by leveraging technology while managing costs. Sustainability will play a bigger role. Overall the industry’s long-term outlook remains optimistic. Firms that can deliver value, quality, and efficiency to clients will thrive in the competitive market.

Conclusion:

The steel detailing industry has been experiencing steady growth in line with rising demand from the construction sector. While emerging regions like APAC currently dominate, developed markets are also projected to expand steadily despite slower building rates. Advancements in technology and software are enabling detailers to take on more complex projects. The future outlook remains positive for skilled detailing firms that can deliver value and efficiency to clients while leveraging the latest innovations.